Summary: Looking back on the steel market last week, the price of steel showed a trend of fluctuating operation, most steel products first fell and then rebounded in the range of 30-50 points; for raw materials and fuels, the iron ore dollar index rose by 6 points, and the scrap steel price index rose by 51 points, the Coke Price Index fell 102 points.

Looking ahead to this week’s steel market, it is expected to continue to show a weak rebound in the operation of the situation, the main reasons: First, the macro-surface warm wind blowing, on the one hand the Central Bank to reduce the quasi-full half a percentage point, a total of long-term release of about 1.2 trillion yuan; On the other hand, the financing of real estate is gradually easing, moreover, the US Treasury Secretary Yellen also came from the US trump to impose tariffs on China leading to the adverse effects of excessive inflation, is expected to enhance confidence; Second, the stock of steel continued to decline, and the decline expanded, more and more places, some varieties of the phenomenon of lack of specifications, some varieties of price increases; third, from the technical point of view, the finished products of the rebound should not have ended.

Situation of various raw materials

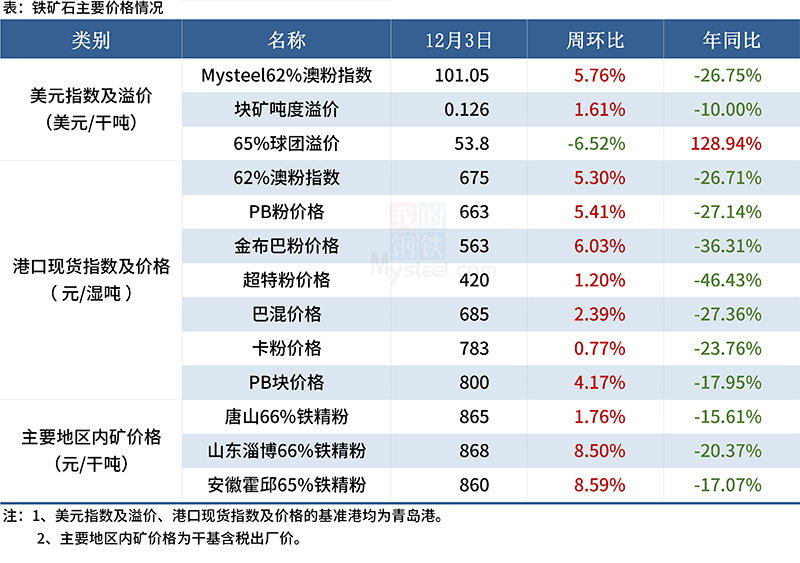

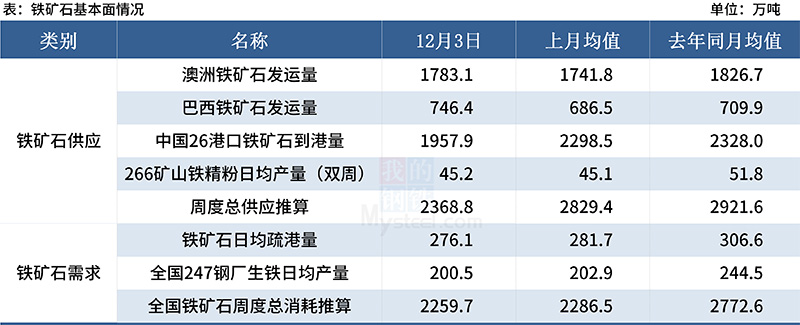

1. Iron Ore

This week, it seems that after the overhaul of some of Australia’s port berths, Australian mines began to carry out year-end impulse, and iron ore shipments increased significantly, reaching a high level for the year. At the same time, domestic iron ore arrivals rebounded sharply at low levels. On the demand side, tangshan has tightened production restrictions and increased the number of new furnace inspections and repairs, and it is expected that the average daily production of hot metal will continue to drop this week; supply increases and demand decreases, the gap between Iron Ore Supply and demand widens, and the extent of accumulated stocks at the port increases. Therefore, from a fundamental perspective, this week the spot price of iron ore fluctuated slightly and ran weakly. However, due to the recent improvement in the demand for finished products, steel prices performed strongly, giving some support to the black market. Therefore, taken together, this week iron ore prices are likely to be dominated by wide swings.

(2) Coal Coke

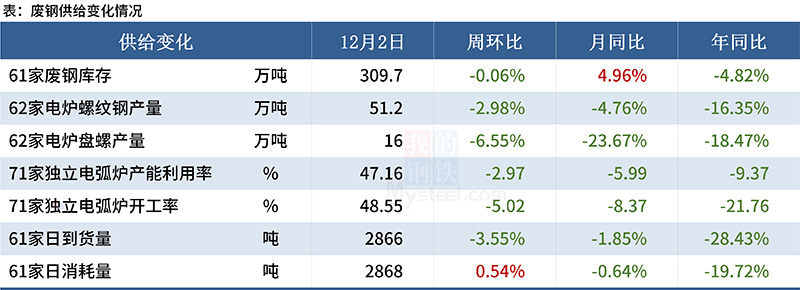

(3) scrap

As the price of finished products is relatively stable, the enthusiasm of steel mills for production increases slightly, the consumption of scrap steel shows a slight improvement, and as market sentiment increases, the arrival of scrap steel from steel mills decreases significantly, and the stock of scrap steel from steel mills with short-flow processes drops especially, the adjustment and increase operations are relatively active; the long process is relatively low in consumption, more goods are delivered in the early stage, the stock level is relatively abundant, and the wait-and-see attitude toward price adjustment is stronger, and due to the continuous expansion of the scrap-molten iron price at present, the impetus for the increase of scrap steel is insufficient, gains will be limited. Scrap prices are expected to remain within a narrow range next week.

(4) billet

Billet profits continue to rise, billet market trading atmosphere from “Urgent”to “Calm”. Under the condition of relatively stable billet supply, it is difficult to release billet demand in downstream rolling mills from the point of view of natural production, and due to the factors such as delivery, import to port and direct pre-sale, etc. . In this situation, in the short term, steel billet inventory or turn down (import Shugang) , but the local resources are difficult to show the reservoir (based on the supply base) , the market trading changes more led by the volatility of the futures market sentiment changes. Comprehensive expected short-term billet prices continue to maintain a narrow range of adjustment.

Situation of various steel products

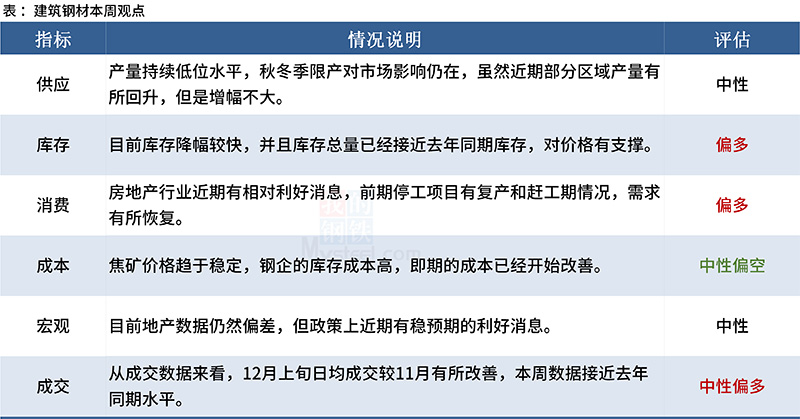

(1) construction steel

Last week construction steel market fundamentals continue to repair, the market mentality gradually stabilized. From the fundamental point of view, construction steel supply and demand increase, demand recovery is more obvious, inventories ushered in a significant decline, if near-term demand to maintain the current state, this week is expected to fall below the level of the same period last year. This will no doubt be a great advantage. Construction steel prices will continue to rebound this week, but the gradual stagnation of demand in the north, the performance of the southern market, regional market prices may be divided, the price gap in the repair process may widen.

(2) medium and heavy plates

Looking back at last week’s domestic market for medium and heavy plate, the overall situation was first up and then down. In the short term, the main focus is on the following factors: supply level, there are certain differences on the future supply pattern at present, on the one hand, the resumption of production is expected to exist in December, but on the other hand, the Winter Olympics production restriction in the first quarter of next year will have a certain impact on the output of the medium plate; in the circulation link, the current regional price difference of the plain plate is relatively small, the resource liquidity is poor, and there is certain space for low-alloy, the difference between the cost price from the north to the east of China and the market price is about 100 Yuan/ton, which will become the main resource heading south. It is expected that the price difference between low alloy and plain plate will show a trend of repair in the future. On the demand side, near the end of the year, the seasonal demand will fall off, which is the trend, although short-term or as a result of the periodic changes in price fluctuations, but in the long term, demand will not rebound significantly. Integrated Forecast, is expected this week thick plate prices in a narrow range of shocks run.

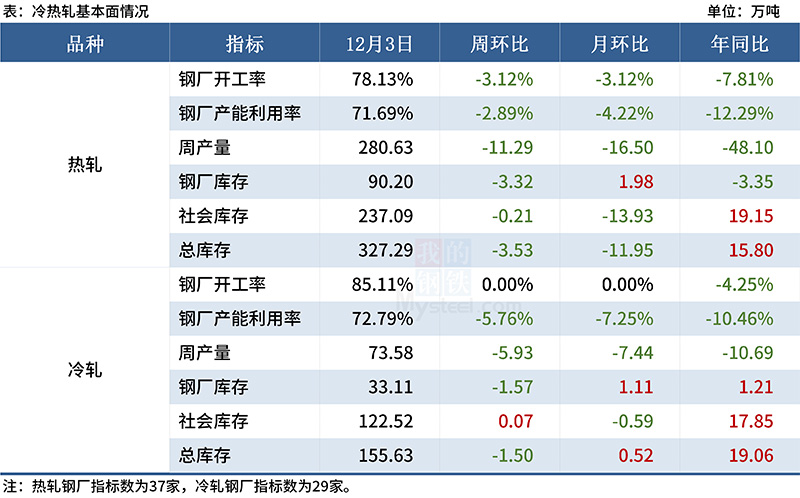

(3) cold and Hot Rolling

From the supply point of view, the profits of the hot rolling mill have recovered obviously in the near future, but the overall output is still restrained obviously by the policy, which makes the overall recovery speed slow down, therefore, for the time being, overall supply will remain low in December; from the Steel Mills’orders received in December, there is a significant improvement in the hot-line orders and the gap has improved; and the cold-line can not be effectively solved due to the problem of auto chips, demand by the real estate drag, consumption decline, domestic production of household appliances decline, market inventory and other factors, leading to the steel order gap is difficult to improve. So on the later trend, the cold system pressure is still greater than the heat system. From the downstream feedback, the order did not show significant improvement, but its own low inventory, just need to take delivery of the situation. In addition, the new order profit can be, so the winter storage willingness has increased, for speculative consumption will be improved. According to Mysteel’s own research, consumer spending is still expected to stabilise in December from November. Feedback from the lower end shows that capital in the construction sector remains tight and shows no signs of easing towards the end of the year, while other sectors have an expected replenishment in December to lock in late-term profits. Overall: Demand temporarily stable, supply rise is not obvious, supply and demand presents tight balance. For the entire bending industry, the pressure from the bottom up to conduct, the current low inventory situation, it is difficult to build confidence in the market will be supported, is not expected to be effectively verified this week, for the price is still a shock adjustment.

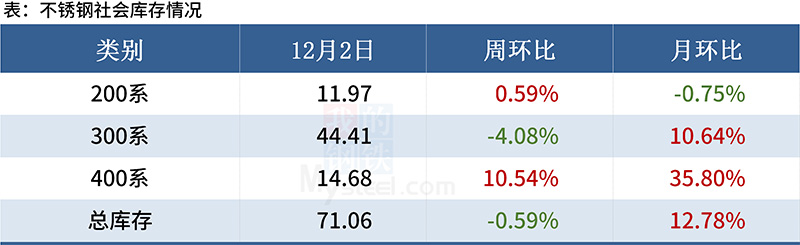

(4) stainless steel

At present, the supply remains normal or even high level, but the demand is weak. Most steel mills are still taking orders in December. Traders and downstream stocks are running lighter at the end of the year. The possibility of a demand explosion before the year is less likely, 304 spot prices are expected to remain volatile and weak this week. At present, most of the actual production of steel into losses, the future price decline is also limited.

Post time: Dec-07-2021