Summary: Looking back at the steel market last week, the price of steel showed a trend of fluctuating operation. Most steel products rose first and then fell in a range of 30 points. As for raw materials, the iron ore dollar index rose by 4 points, scrap Steel Price Index rose 64 points, coke price index fell 94 points. Looking ahead to the steel market this week, it is expected that the situation will continue to show choppy operation. The main reasons are as follows: First, the central economic conference has decided to set the year 2022 as a stable year; on the one hand, it has highlighted the greater downward pressure on the economy at present and even in the coming period, on the other hand, it also indicates that the overall economic situation in 2022 or steady progress; second, small increase in steel production month-on-month, inventory decline narrowed, the strength of support for steel prices weakened; Third, this week is the Federal Reserve and the European Central Bank meeting time window, is also 2201 contracts into the delivery month before the game stage, long and empty.

1. Macro

The economic work of 2022 requires that we forge ahead steadily and make steady progress, continue to implement a proactive fiscal policy and a prudent monetary policy, make appropriately advanced infrastructure investment, and promote a sound cycle and healthy development of the real estate industry through urban policies, do not engage in sports “Carbon reduction”. At present, the financing demand of China’s real economy is weak, consumption and investment are insufficient, foreign trade exports maintain rapid growth, and macro-policies are warm.

The situation of each kind of raw materials

1. Iron Ore

As of this week, iron ore shipments and arrivals to Hong Kong have both decreased according to the shipping plan and the shipping rhythm. However, with the lifting of production restrictions in Tangshan and plans to resume production of blast furnaces in other regions, hot metal production will rise to a certain extent, however, the increase of hot metal output is limited under the environment protection, the port stock does not change the trend of accumulation, the supply-demand gap is still loose, and the price remains weak.

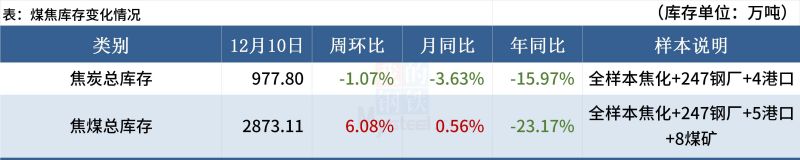

(2) Coal Coke

(3) scrap

Finished products market in the continued rise after the state of mind tends to be cautious, coupled with the subsequent arrival of the off-season, winter storage brings great pressure, short-term or shock callback. From the perspective of screw waste difference and plate waste difference, the current steel mill still has a certain profit, but considering factors such as limiting production in winter in north China and double control of energy consumption, the demand for scrap steel has not improved obviously; from the perspective of scrap iron difference, the current scrap steel price is already higher than the cost of molten iron, the economic benefit of scrap is declining, and the willingness to purchase scrap is weak in view of long process. In addition, compared with other commodities year-on-year, scrap prices have been at a high level, there is a risk of decline. Comprehensive judgment, scrap prices are expected to oscillate slightly weaker this week.

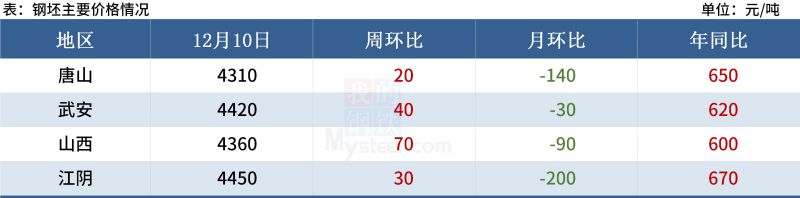

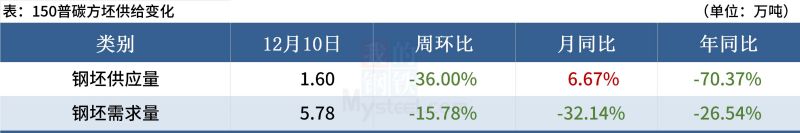

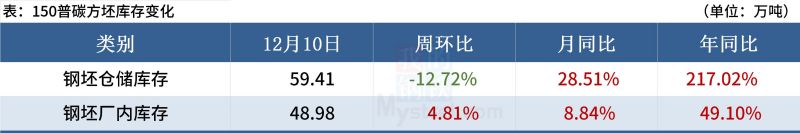

(4) billet

Billet profits slow down, driving factors from cost reduction to price rebound. Tangshan area environmental protection limit production frequently, the supply and demand double weak situation, the price rebound is mainly led by the futures market. From the current market point of view, based on the continuous and difficult release of billet supply, under the operating environment of downstream steel rolling plants, the stock of finished products in the plant continues to drop, and the low stock status of most discontinued factories has already resulted in the phenomenon of the lack of variety and specifications, the sentiment of resuming production and restocking will be prominent, and the reduction of the cost of rolling steel will lead to an apparent increase in production and sales profits. In addition, the trend of decreasing the quantity of imported steel billets arriving at Port is obvious, or the situation of dredging ports will be maintained continuously, this brings billet prices in the lower stage of the resumption of the driving force of the price. However, from the current market performance, the relative prominence of pessimism, to a certain extent, the impact of billet prices continued upward. Comprehensive expected short-term billet prices will reflect the “Bottom support, limited increase”situation.

Situation of various steel products

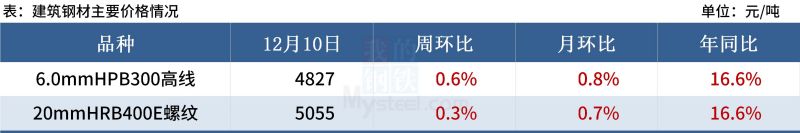

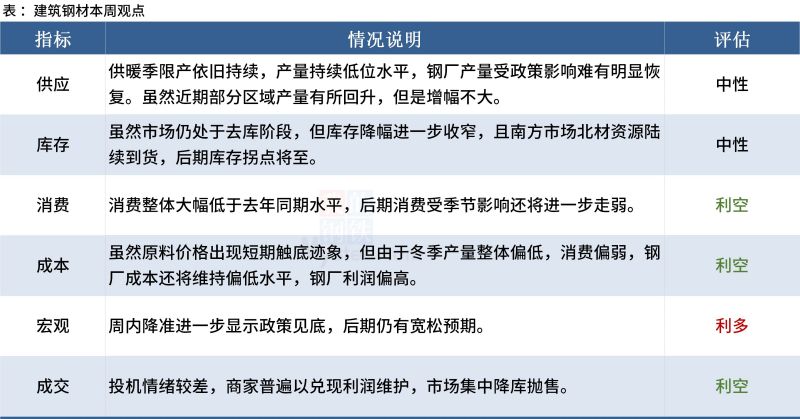

(1) construction steel

This week, the supply side may be difficult to change too much, although the steel mill profits have been repaired, the resumption of power increased, but by the Winter Olympics and autumn and winter production restrictions, limited room for output recovery. In terms of time cycle, the trend of demand weakening will be difficult to change as the weather cools and the Spring Festival approaches. However, from November to date the transaction situation across the country, the overall performance of demand tone is firmly in the lead. Although the northern region recently suffered the impact of cooling, but as the main demand at this stage of the southern region, short-term weather still does not affect the construction site, the overall demand next week or will be maintained. At present has entered the stage of winter storage, east and south China demand main areas gradually increased the proportion of site completion, terminal actual just need to have no improvement. Therefore, rebar prices have resistance, under a certain level of support, combined with domestic construction steel prices this week or will be mainly weak shocks.

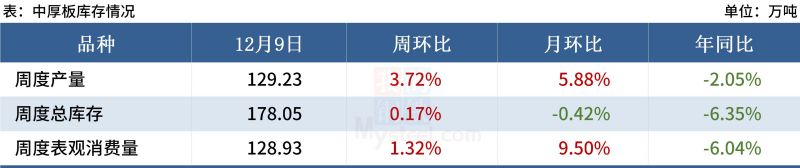

(2) medium and heavy plates

On the supply side, the North Steel Mills have resumed production one after another in the near future. In east China, the increase in production is the main factor, and the output of medium plate in the whole country has shown a low-level rebound trend. It is expected that short-term output still has a little room to go up. In circulation, competition for ordinary plate orders is relatively fierce, the market speculation demand is poor, the phenomenon of steel mills letting prices to seize orders is obvious, the low alloy pressure is smaller, at present it maintains a large price difference with the General Board; on the demand side, the overall demand is depressed, adding the impact of some regional public health events, the downstream, the warehouse is shut down, no significant improvement is expected in the short term. Integrated Forecast, this week plate prices weak operation.

(3) cold and Hot Rolling

From the point of view of supply, the short-term output of hot and cold rolling is at the bottom, especially the output of hot rolling and cold rolling is expected to return to the level of around 2.9 million tons/week in December with the completion of overhaul, due to the current profit of hot rolling mill, the market as a whole has a strong resumption of production expectations, but also to ensure next year’s production base. From the demand point of view, short-term consumption just needs to maintain, but this year there is an early holiday expectations, for the whole chain, consumption in the short-term there is no prominent bright spot; in addition, steel mills for January orders are still expected to be poor, short-term pressure from the bottom up, orders and long-term coordination problems are still the most obvious problems plaguing the spot end, that demand is still expected to decline. From the point of view of market resources, on the one hand, because most steel mills are under great pressure to receive orders, in December, in order to fill orders, the steel mills receiving orders had the behavior of lowering prices and only negotiating shipments below the spot market price, there are resource costs below current prices in the market. On the other hand, with the recovery of steel production, the market will gradually increase the volume of goods, market pressure is gradually reflected. Therefore, on the whole, the supply and demand pressure is gradually under pressure, at the same time in the arrival of increased volume and merchants want to cash out, and in December some low-priced resources flow to the market, hot and cold spot prices are expected to continue weak operation.

(4) stainless steel

At present, the overall stainless steel demand still shows no signs of improvement, the overall inventory is at a higher level, the market sentiment is still dominated by pessimism, but the market may be stimulated by the news of the steel mill production reduction has fluctuated, mainly concerned about the change in trading conditions, 304 spot prices are expected to be volatile this week.

Post time: Dec-14-2021