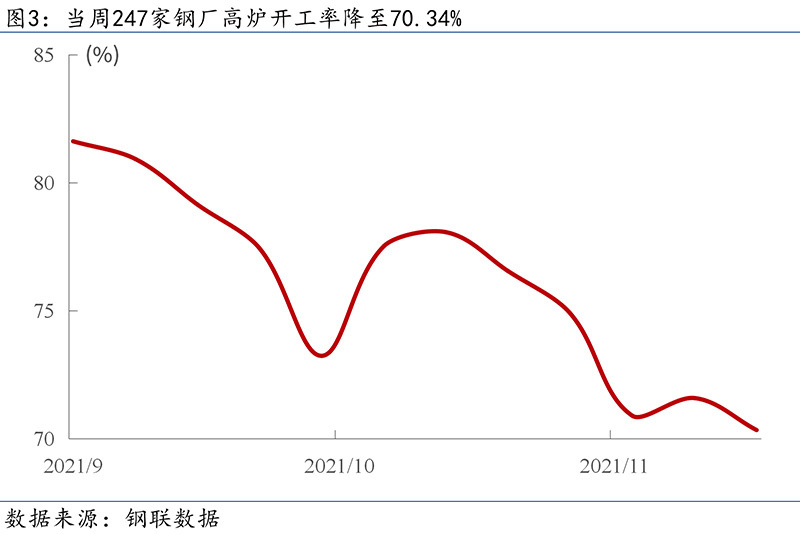

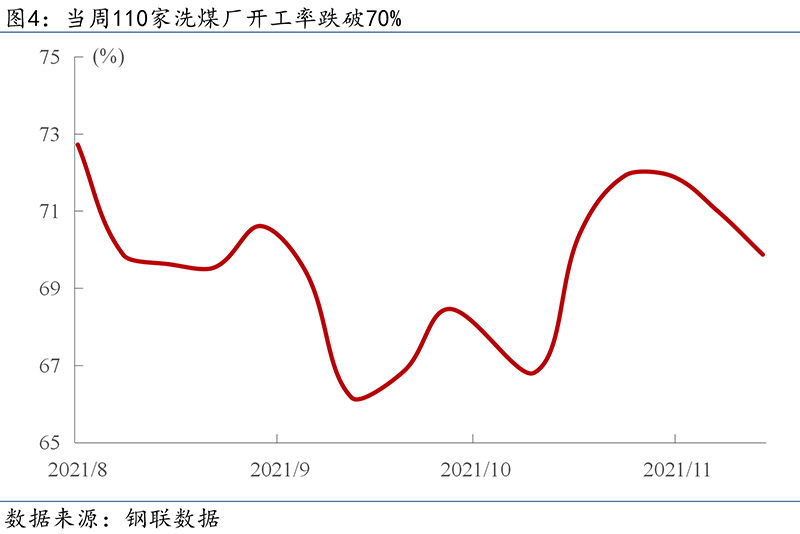

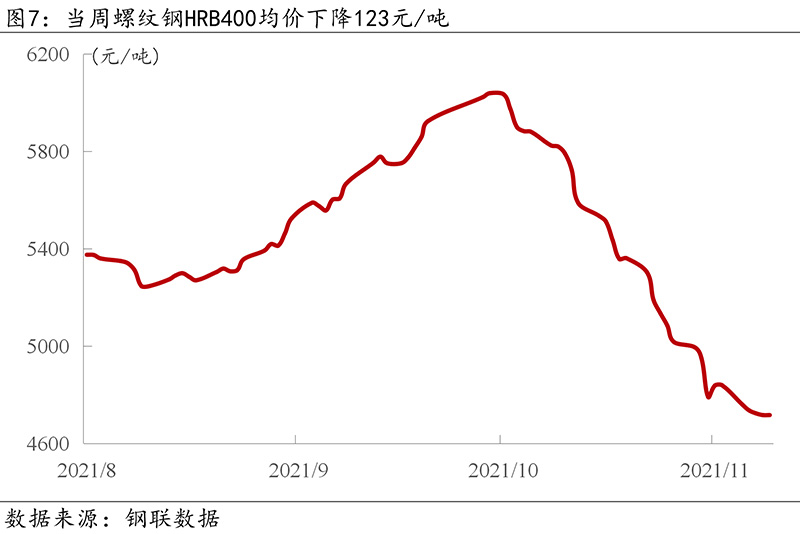

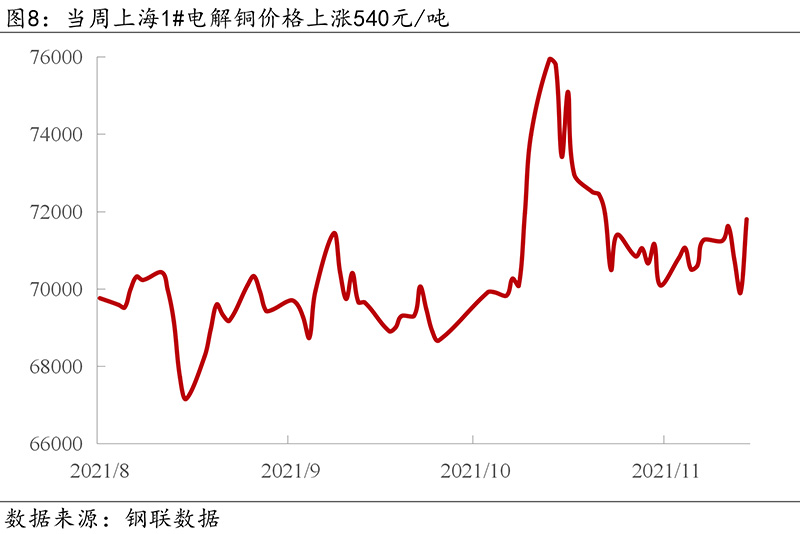

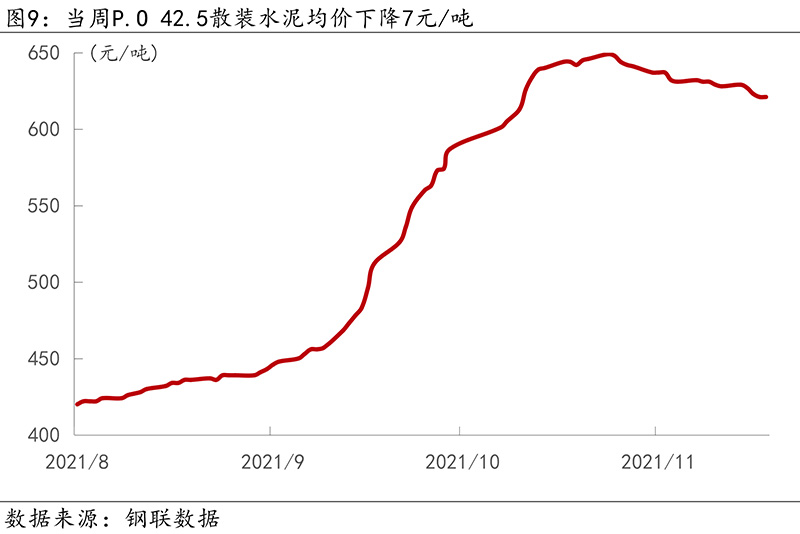

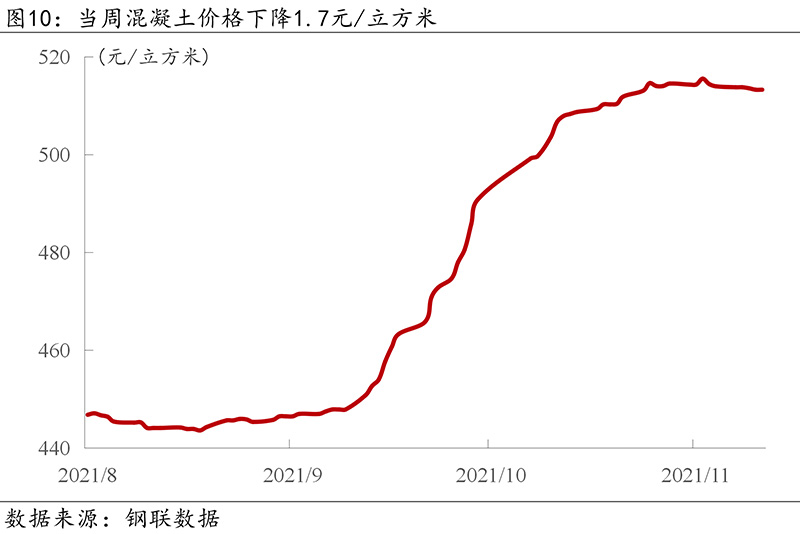

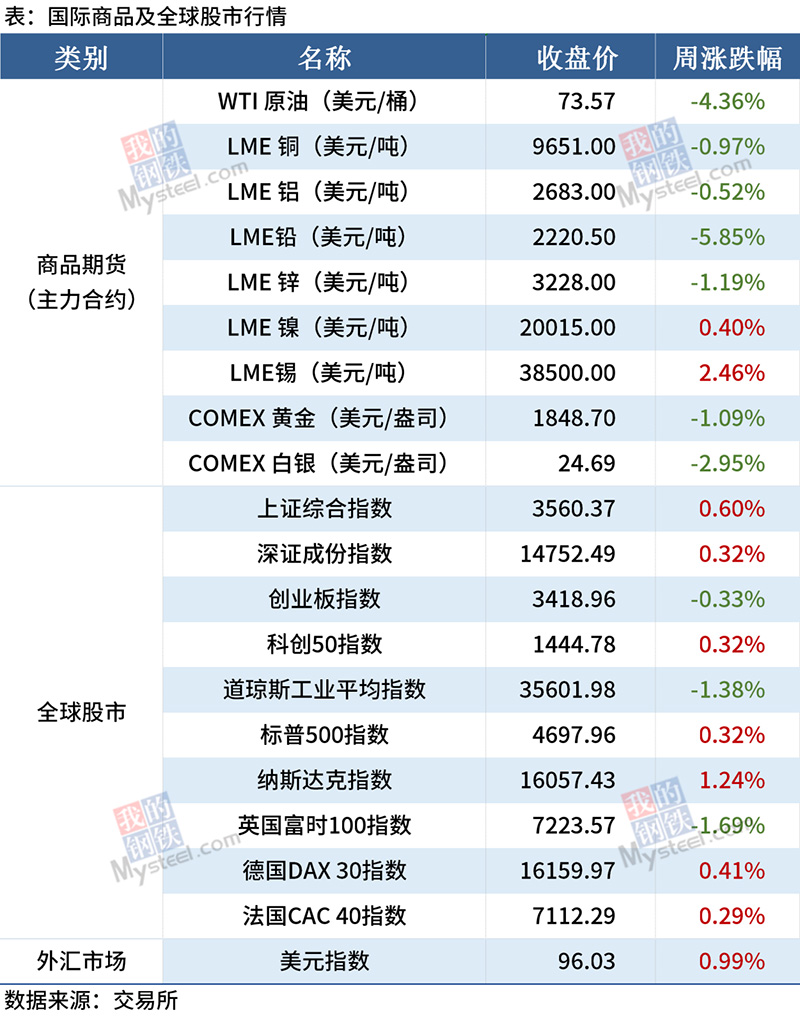

Week in the Big Picture: President Xi Jinping held a video conference with U.S. President Biden; key economic data from China released in October showed industrial production exceeding expectations, investment growth continuing to slow, and consumption data picking up; China’s steel industry carbon peak implementation plan and carbon-neutral Technology Road Map will be published and implemented. Initial jobless claims in the US hit their lowest level since the outbreak, while economic growth accelerated in the 19-nation eurozone. Data tracking: On the capital side, when the central bank netted 90 billion yuan; Mysteel survey 247 blast furnace operating rate fell to 70.34% , the country’s 110 coal preparation plants operating rate fell below 70% ; when the week rebar prices continued to decline, iron ore, electrolytic copper prices rose slightly; Prices of cement and concrete fell; daily sales of passenger cars averaged 46,000 units that week, down 23 per cent; and Bdi dropped 9.6 per cent. Financial Markets: This week’s major commodity futures fell precious metals, crude oil fell 4.36% ; the world’s three main indexes of U.S. and Chinese stocks fell; the U.S. dollar index rose 0.99% , to 96.03.

President Xi Jinping held a video meeting with President Biden of the China Standard Time on the morning of November 16 to exchange views on china-us relations and issues of common concern, the two sides exchanged views on strategic, overall and fundamental issues concerning the development of bilateral relations. Xi stressed that China and the United States should adhere to three principles in their relations in the new era: First, mutual respect, second, peaceful coexistence and third, win-win cooperation. Xi stressed that if Taiwan independence breaks through the red line, we will have to take drastic measures, and those who play with fire will surely get burned! Biden said he would like to reiterate unequivocally that the US government is committed to the long-standing one-china policy and does not support “Taiwan independence”.

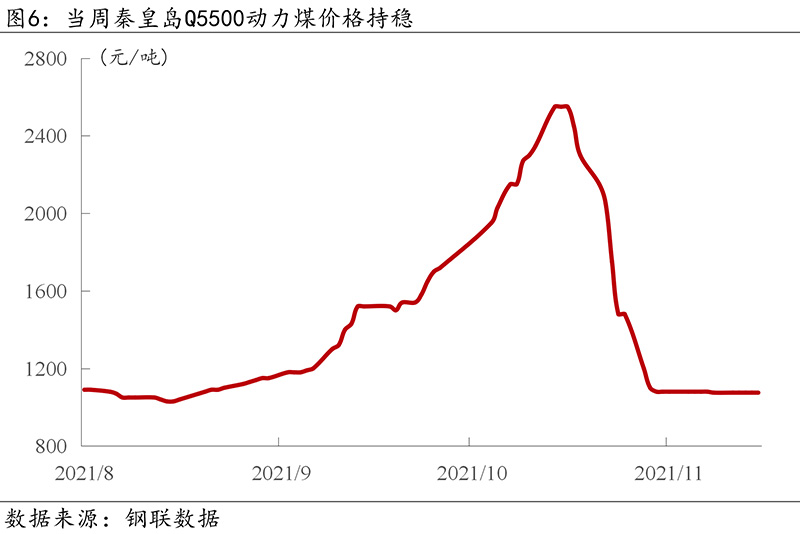

On the morning of November 12, the National Development and Reform Commission held a meeting of the Leading party group. The meeting pointed out that bottom-line thinking, focusing on development and security, do a good job in food security, energy security, industrial chain supply chain security, and do a good job in finance, real estate and other areas of risk management and prevention. The Politburo of the Communist Party of China held a meeting on 18 November, which stressed the need to strengthen the resilience and resilience of the industry, build a strong baseline against systemic financial risks, and ensure food security, energy and mineral security, and the security of key infrastructure, we will strengthen the security protection of overseas interests. On November 17, Premier Li Keqiang presided over the China State Council executive meeting, which decided to set up a special loan to support clean and efficient use of coal to promote green and low carbon development. At the meeting, it was decided to set up another 200 billion yuan to support the clean use of coal on the basis of the earlier establishment of a financial support tool for carbon emission reduction. Xi attaches great importance to the development of manufacturing, saying that manufacturing is the foundation for building a country and the foundation for strengthening it, Vice Premier Liu He said at the 2021 World Manufacturing Conference, which opened on November 19, to promote the manufacturing industry to accelerate to digital, networking, intelligent development. China is undergoing a profound change in its economic development model. The foundation of high-quality development is a higher-level and more competitive manufacturing industry. All localities and departments should earnestly solve the current difficult problems for the manufacturing enterprises. Financial Institutions should increase financial credit support to manufacturing enterprises to ensure their reasonable capital requirements.

Ä å”ä å”ä Å”National Development and Reform Commission: Ä å”ä å”ä å”ä å”ä å”ä å”ä ä å”ä ä å”ä å”ä ä å”ä ä ä å”. With regard to the “1 + N”follow-up policy system, deployed in accordance with the Leading Group on Carbon Neutrality at carbon peak, relevant departments are studying and formulating implementation plans for energy and other fields and key industries such as steel, petrochemical, Non-ferrous metal, building materials, power, oil and gas.

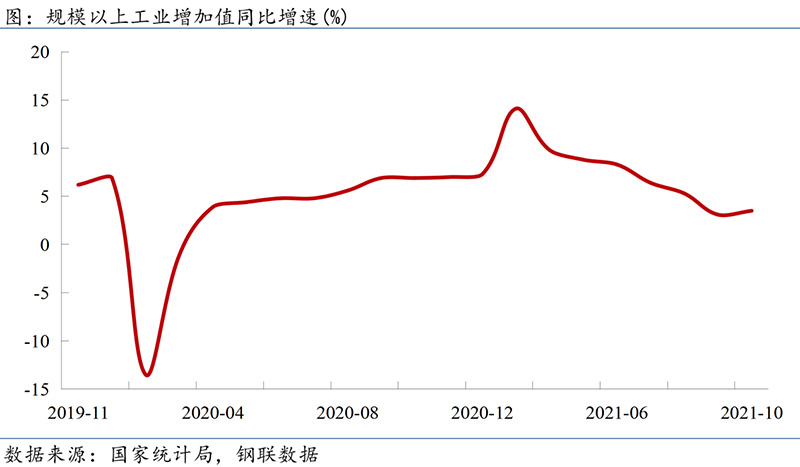

On November 12, the CBRC held a party committee (enlarged) meeting. The meeting requested that the bottom line of non-occurrence of systemic financial risks should be firmly maintained. We will stabilize land prices, house prices and expectations, curb the tendency of real estate to become a financial bubble, improve the long-term mechanism of real estate regulation and control, and promote the steady and healthy development of the real estate industry. Industrial added value exceeded expectations in October. In October, the value added of industries above the national scale increased by 3.5 percent year-on-year, 0.4 percentage points faster than the previous month. Growth in industrial production has ended a seven-month streak of declines. From the three categories, mining, electrical water production and supply of both faster than in September, manufacturing in the high-tech, equipment, consumer goods industries have rebounded to varying degrees.

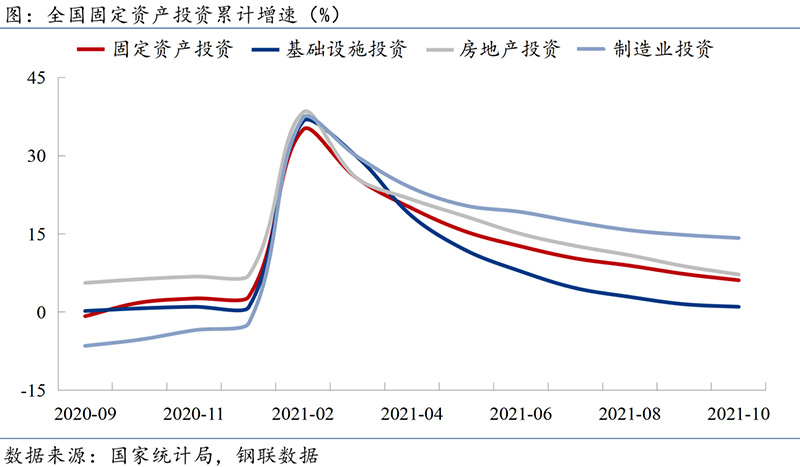

The growth rate of investment continued to slow in October. From January to October, fixed asset investment rose 6.1 per cent year-on-year, a 1.2 percentage point increase from the previous nine months. In terms of sectors, infrastructure investment increased by 1.0% year-on-year and narrowed by 0.5 percentage points; real estate investment increased by 7.2% year-on-year and narrowed by 1.6 percentage points; and manufacturing investment increased by 14.2% year-on-year and narrowed by 0.6 percentage points. Investment in infrastructure is constrained by many factors, including the slow progress of financial capital expenditure, the lack of high-quality projects and the strict supervision of projects. Due to the real estate financing tightening and the slow return of funds and other factors, real estate investment continued to fall. Affected by the flood situation, limited production and power supply, and other short-term constraints weakened, manufacturing investment momentum repair accelerated.

The growth rate of investment continued to slow in October. From January to October, fixed asset investment rose 6.1 per cent year-on-year, a 1.2 percentage point increase from the previous nine months. In terms of sectors, infrastructure investment increased by 1.0% year-on-year and narrowed by 0.5 percentage points; real estate investment increased by 7.2% year-on-year and narrowed by 1.6 percentage points; and manufacturing investment increased by 14.2% year-on-year and narrowed by 0.6 percentage points. Investment in infrastructure is constrained by many factors, including the slow progress of financial capital expenditure, the lack of high-quality projects and the strict supervision of projects. Due to the real estate financing tightening and the slow return of funds and other factors, real estate investment continued to fall. Affected by the flood situation, limited production and power supply, and other short-term constraints weakened, manufacturing investment momentum repair accelerated.

United States Secretary of the Treasury Yellen said the United States is willing to review and consider reducing the tariffs that Donald Trump has previously imposed on China. In the week ended Nov. 13,268,000 people filed for unemployment benefits, the lowest level since the outbreak began, according to the United States Department of Labor. Analysts said the number was below 300,000 for several weeks, reflecting a sustained recovery in the job market.

The Ministry of Commerce: From January to October, China absorbed 943.15 billion yuan of foreign investment, an increase of 17.8 percent year-on-year. China’s central bank contributed 21.2 trillion yuan in foreign exchange at the end of October, up 10.9 billion yuan from the previous month. In October, electricity consumption continued to grow to 660.3 billion kwh, up 6.1 percent year-on-year and 14.0 percent over the same period in 2019, an average increase of 6.8 percent over the previous two years. On November 18, in the office building of the State General Administration of Market Supervision and administration, the State Anti-monopoly Bureau was officially listed. He Wenbo, Executive Director of CISA: China’s steel industry carbon peak implementation plan and carbon-neutral Technology Road Map has been basically completed, will be announced to the community in the near future, and fully start implementation. Learned from the financial management departments and a number of banks, real estate loans in October than September a sharp rebound, increase more than 150 billion yuan. Among them, real estate development loans increased by more than 50 billion yuan, and individual housing loans increased by more than 100 billion yuan. The financing behavior of the financial institutions to the real estate industry has improved obviously. Ministry of Transport of the People’s Republic of China: by 2025, a system of high quality standards for transport will be basically established, the standardized operation mechanism will be further improved, and the level of standards internationalization will be significantly raised.

In October, the output of large, medium and small tractors totaled 39,136, down 28 percent year on year and 10 percent month on month. The cumulative output from January to October was 486,000 units, up 5 per cent year-on-year. In October, China’s output of color TV sets was 17.592 million, down 5.5 percent year-on-year, and the cumulative output from January to October was 148.89 million, down 4.9 percent year-on-year. 2021 in October, October, China’s air conditioning production 14.549 million units, up 6.0% year on year; january-october cumulative production 180.924 million units, up 12.3% year on year. On November 15, China Construction Machinery magazine published the top 10 crane manufacturers in the world in 2021. The total sales of the top 10 crane manufacturers were us $21.369 billion, up 21.2% year-on-year. Zoomlion topped the list with $5.345 BN, up 68.05 per cent year-on-year and two places higher than the previous ranking.

CCMA excavation machinery branch: at the end of 2021, China’s excavation machinery market is expected to hold about 1.434 million units in six years, up 21.4% year on year; about 1.636 million units in eight years, up 14.6% year on year; and about 1.943 million units in ten years, year-on-year increase of 6.5% . From November 8 to 14,2021 received orders for 17 + 2 new ships from shipyards around the world, including 5 from Chinese shipyards and 10 + 2 from Korean shipyards. U.S. retail sales rose 1.7 percent in October, compared with a forecast of 1.4 percent. Foreign Holdings of treasuries fell to $7,549 BN in September, the first decline since March, according to the latest figures from the US Treasury. ? Eurostat: growth in the 19 eurozone countries was 3.7 per cent higher than in the third quarter of 2020, in line with earlier estimates and as the economy continues to recover strongly from the recession triggered by the 2020 epidemic. The eurozone’s CPI rose 4.1 per cent year-on-year in October, compared with a 3.4 per cent rise in September. Japan’s Kishida government on the 19th at the interim cabinet meeting passed a resolution, decided to launch a fiscal stimulus spending of 55.7 trillion yen a new round of economic stimulus plan, set a record for all previous economic stimulus plans.

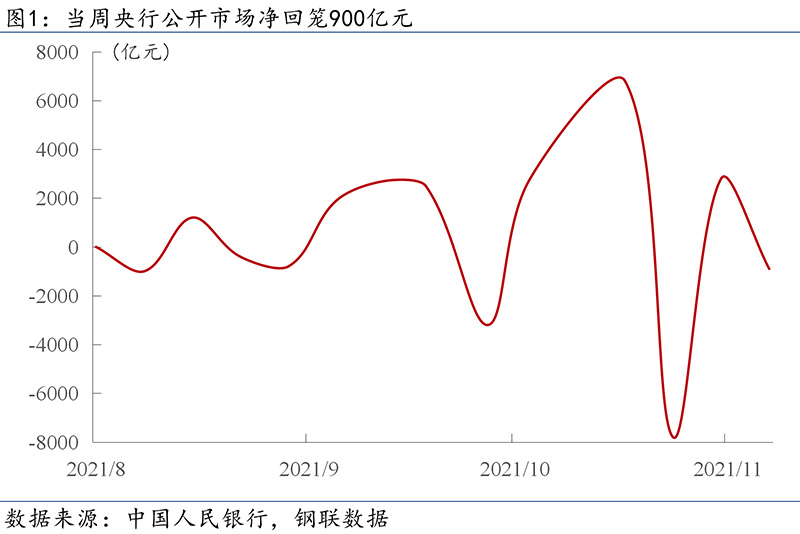

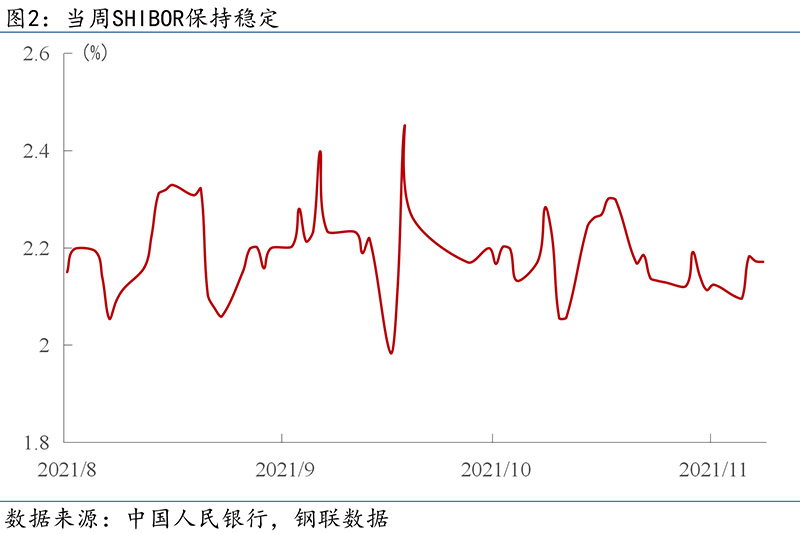

Data tracking (1) financial aspects

(2) industry data

3. Overview of financial markets in the week, commodity futures were mostly lower, with precious metals trading down, Non-ferrous metal trading mixed, and crude oil down 4.36% . On the global stock market, Chinese stocks rose and fell, while the three major indexes of U. S. stocks fell. In the foreign exchange market, the dollar index closed up 0.99 per cent at 96.03.

Key figures for next week (1) China will announce the profit time of industrial enterprises above the scale of October: Saturday (11/27) comments: in the third quarter of this year, affected by the epidemic situation, flood season, tight supply of some energy and raw materials, etc. , industrial production growth has slowed. Since October, positive changes have taken place in industrial production with the gradual easing of restrictive factors and the strengthening of market guarantees for supply and price stability.

(2) summary of key statistics for next week

Post time: Nov-25-2021