Updated every Sunday before 8:00 am to get a full picture of the week’s macro dynamics.

Overview of the week:

China’s official manufacturing PMI was 49.2 in October, the second consecutive month in a contraction range. The National Development and Reform Commission (NDRC) called for a nationwide upgrade of coal-fired power units The Federal Reserve left interest rates unchanged, announcing the start of the “Shrinking table”in November.

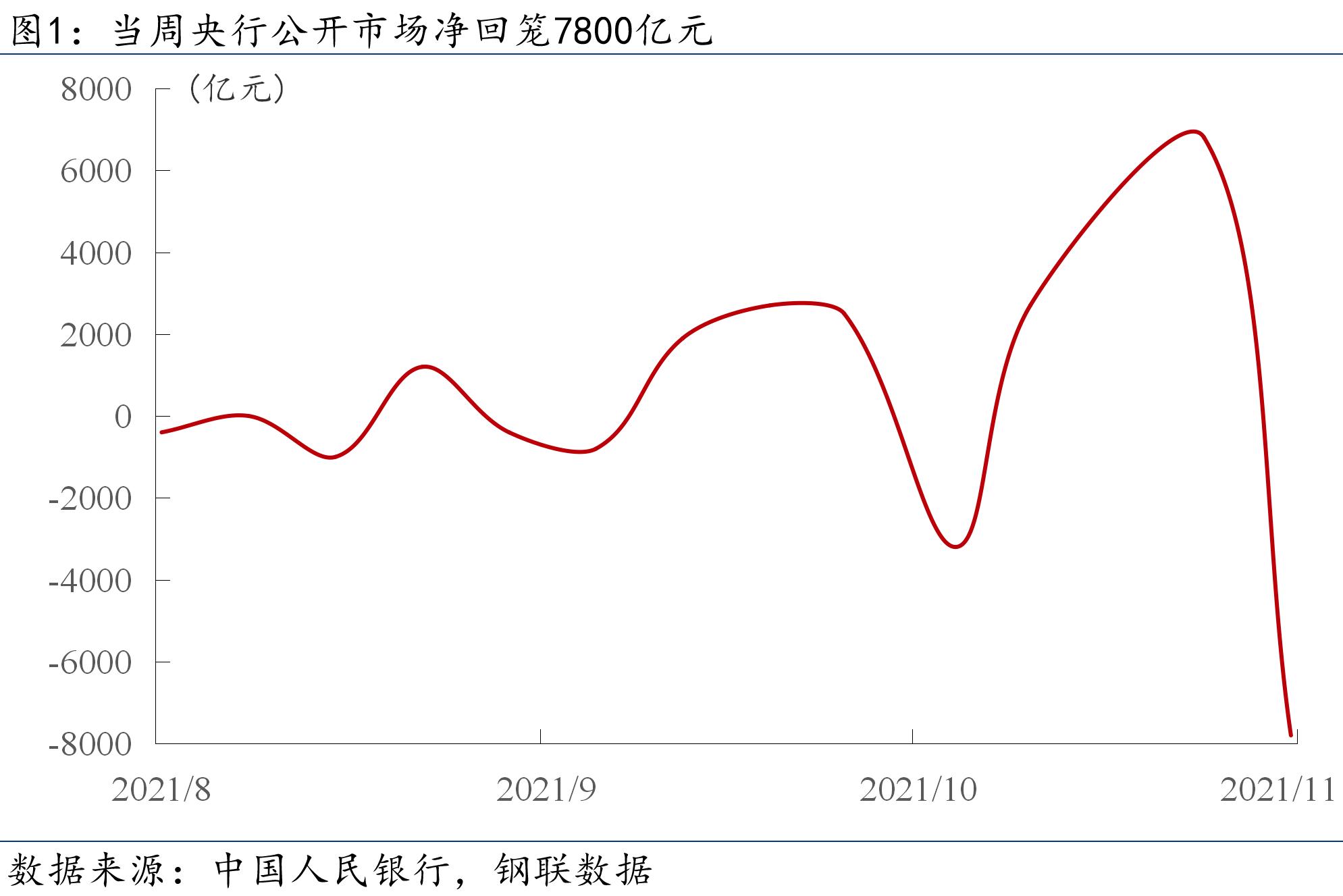

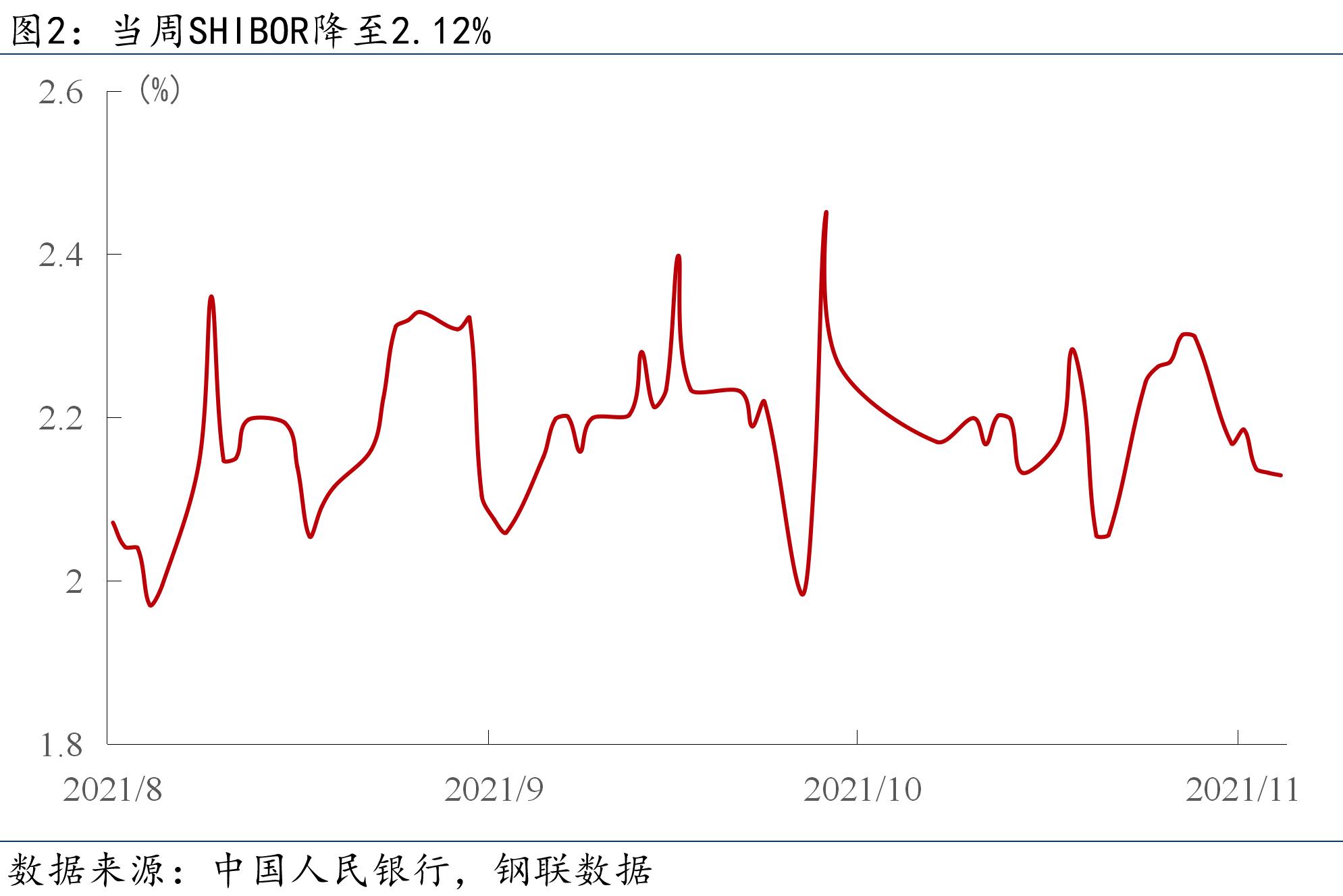

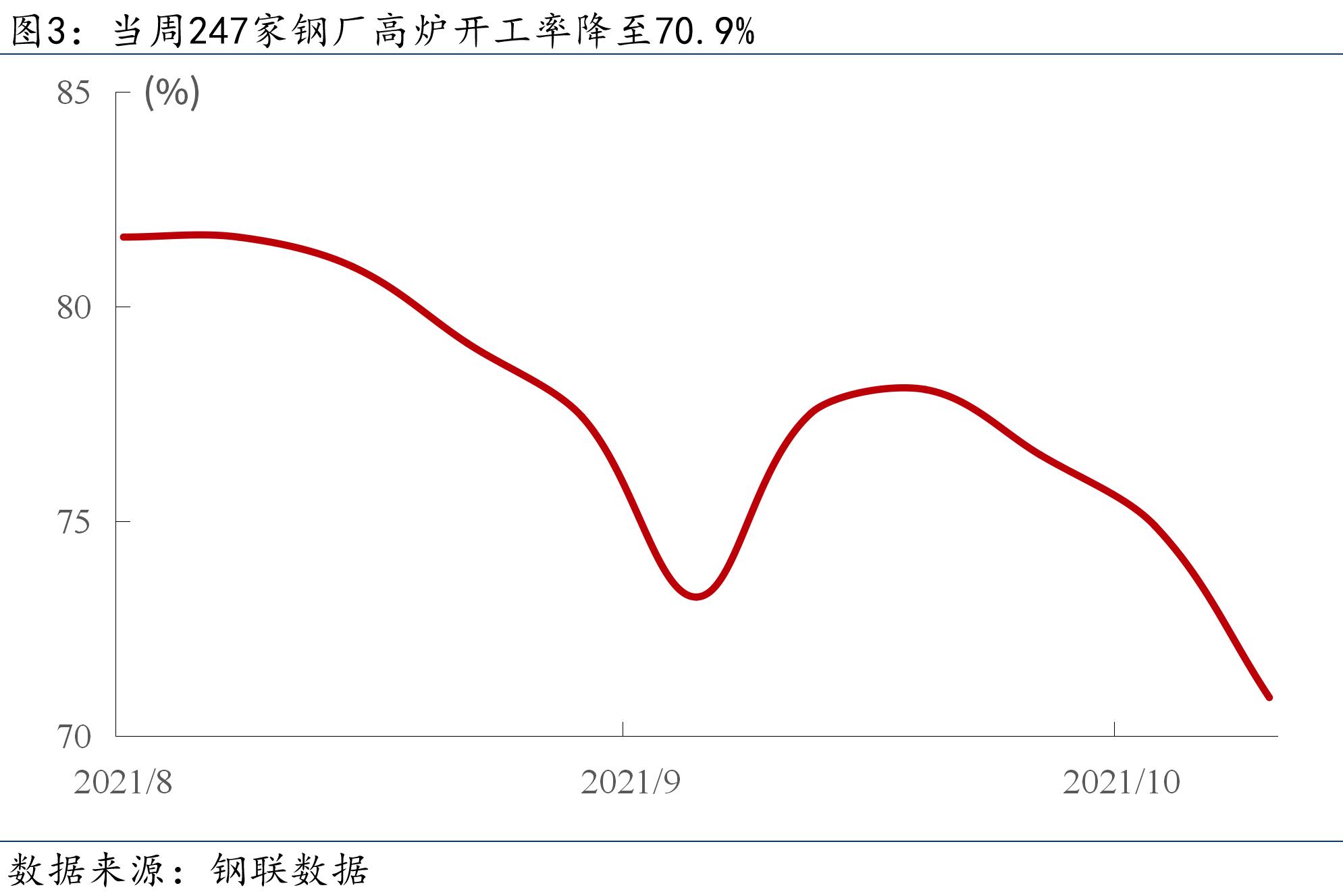

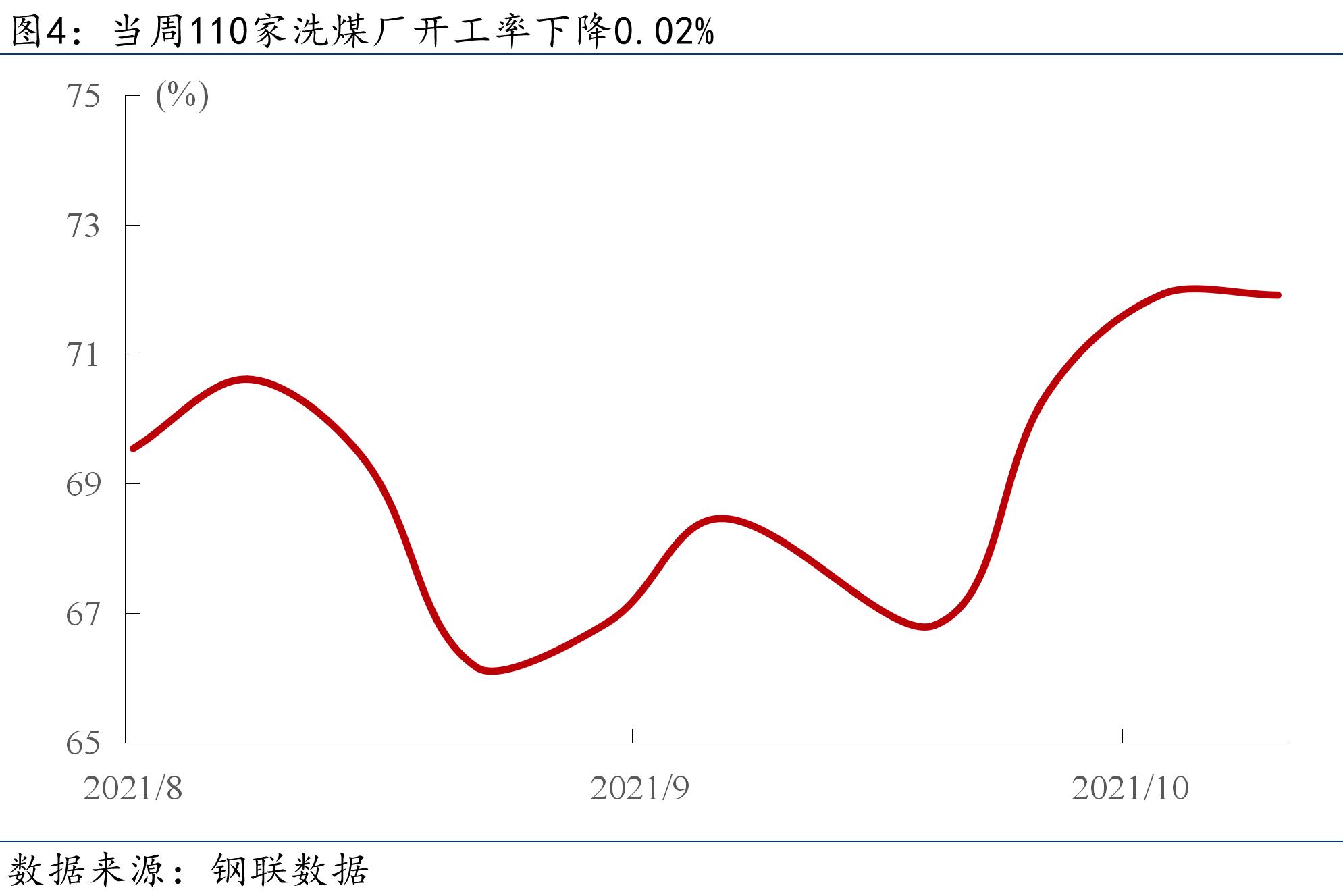

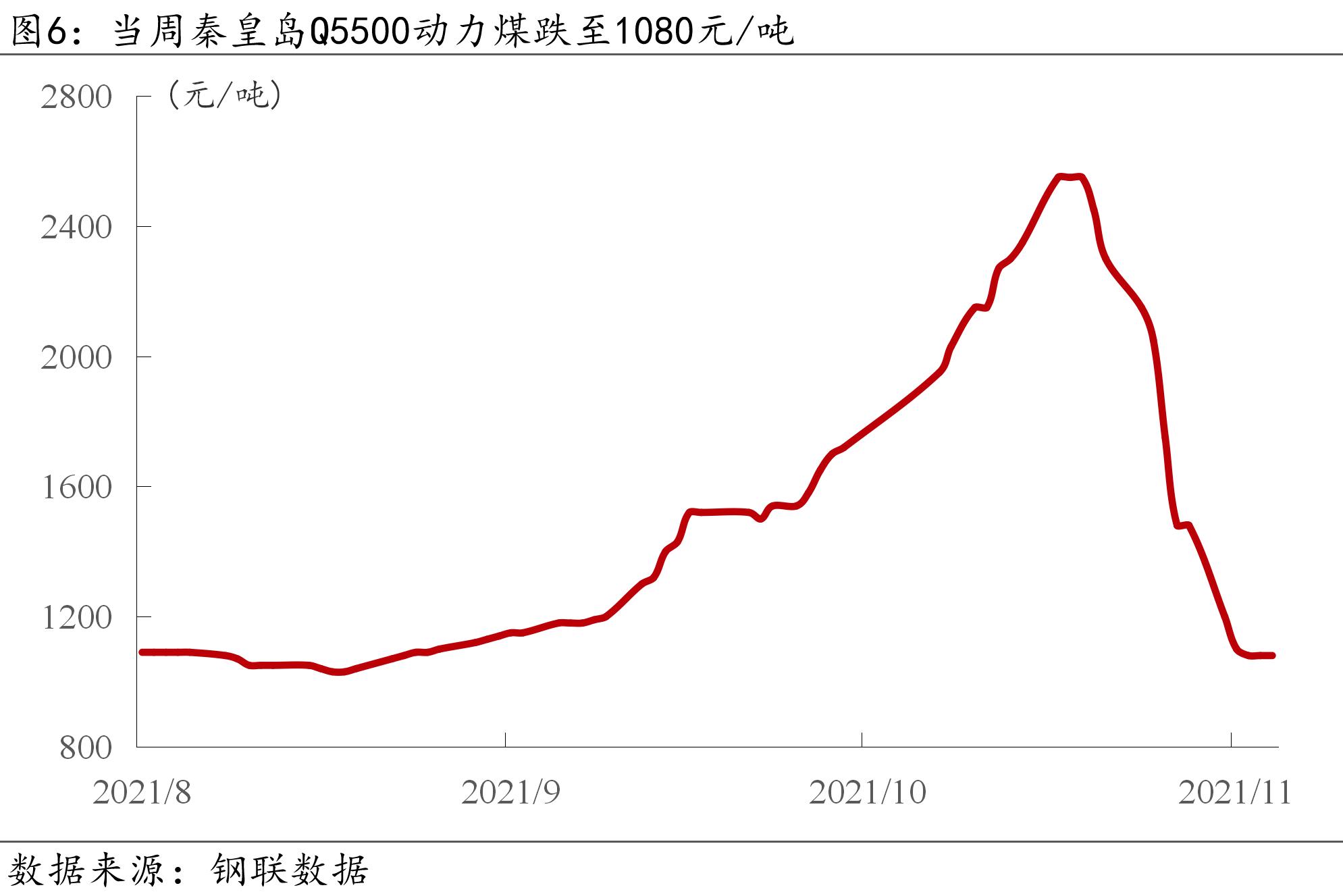

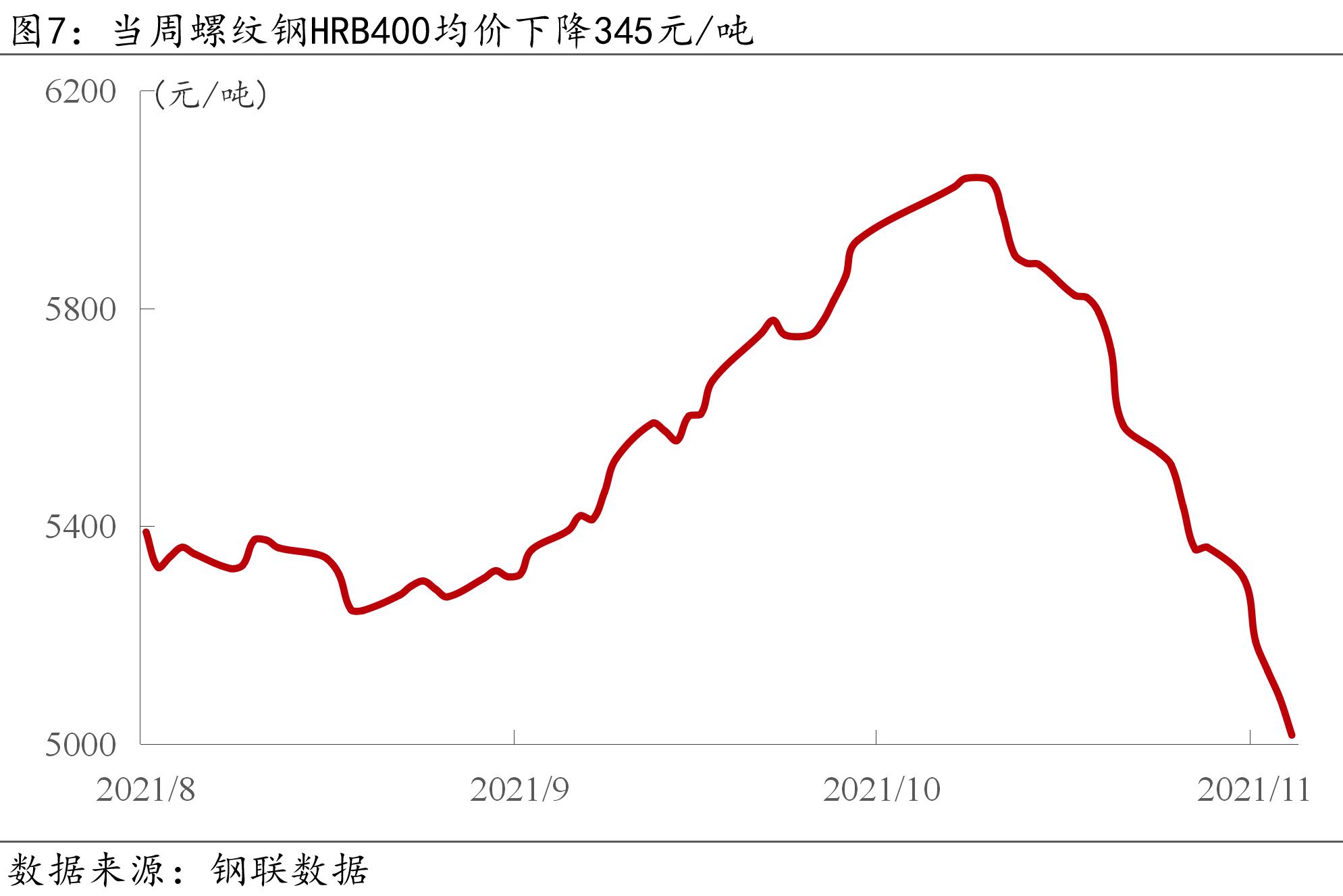

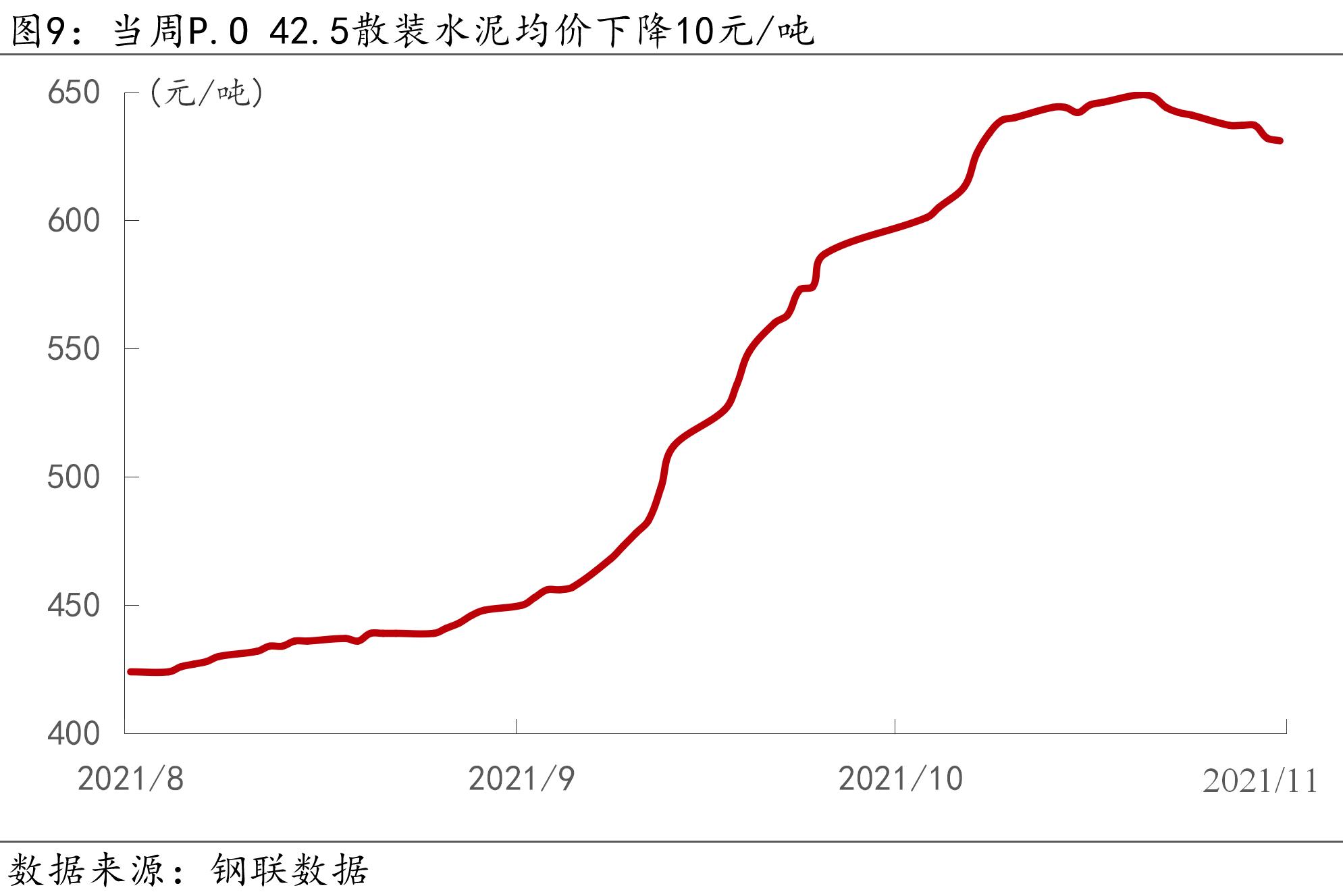

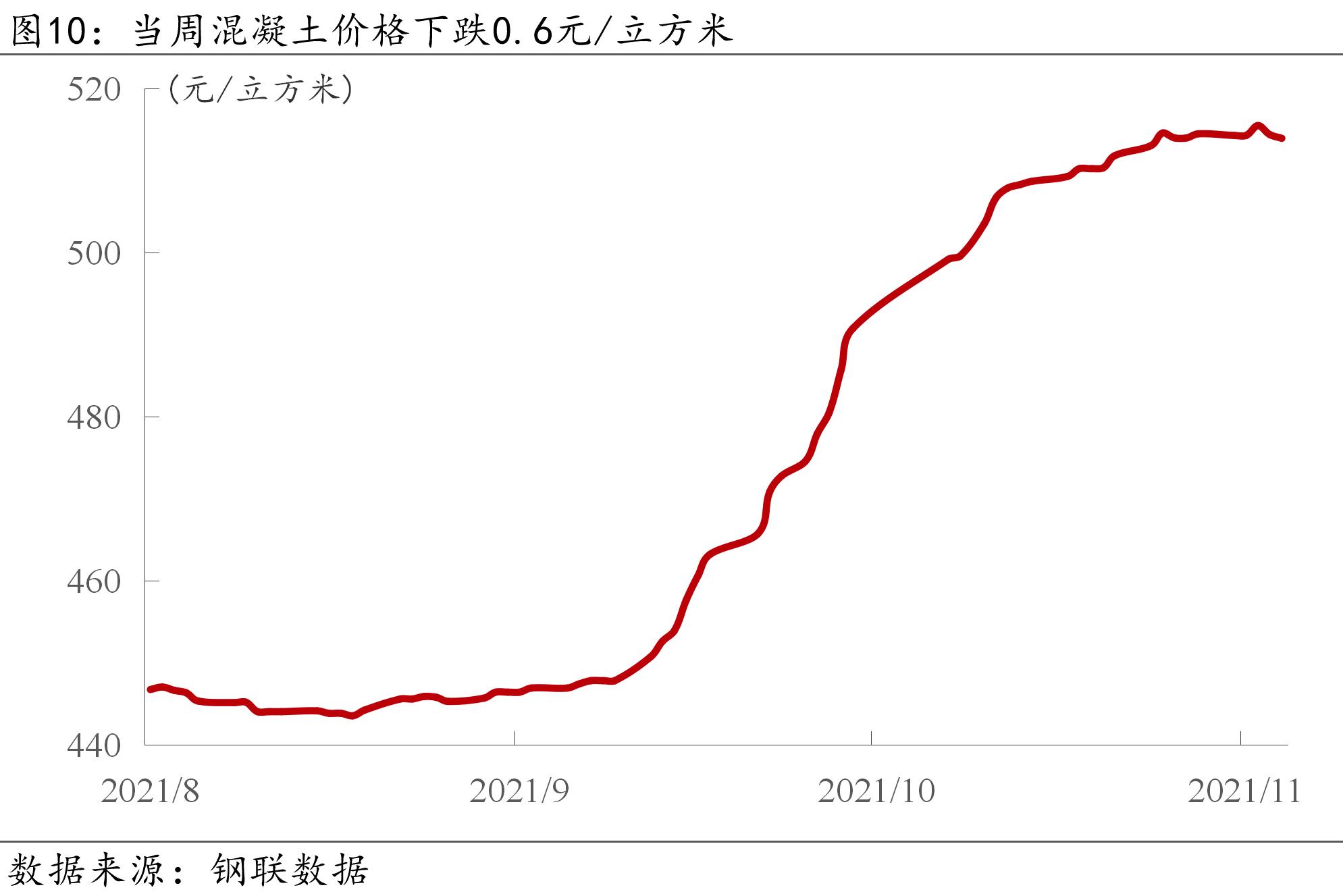

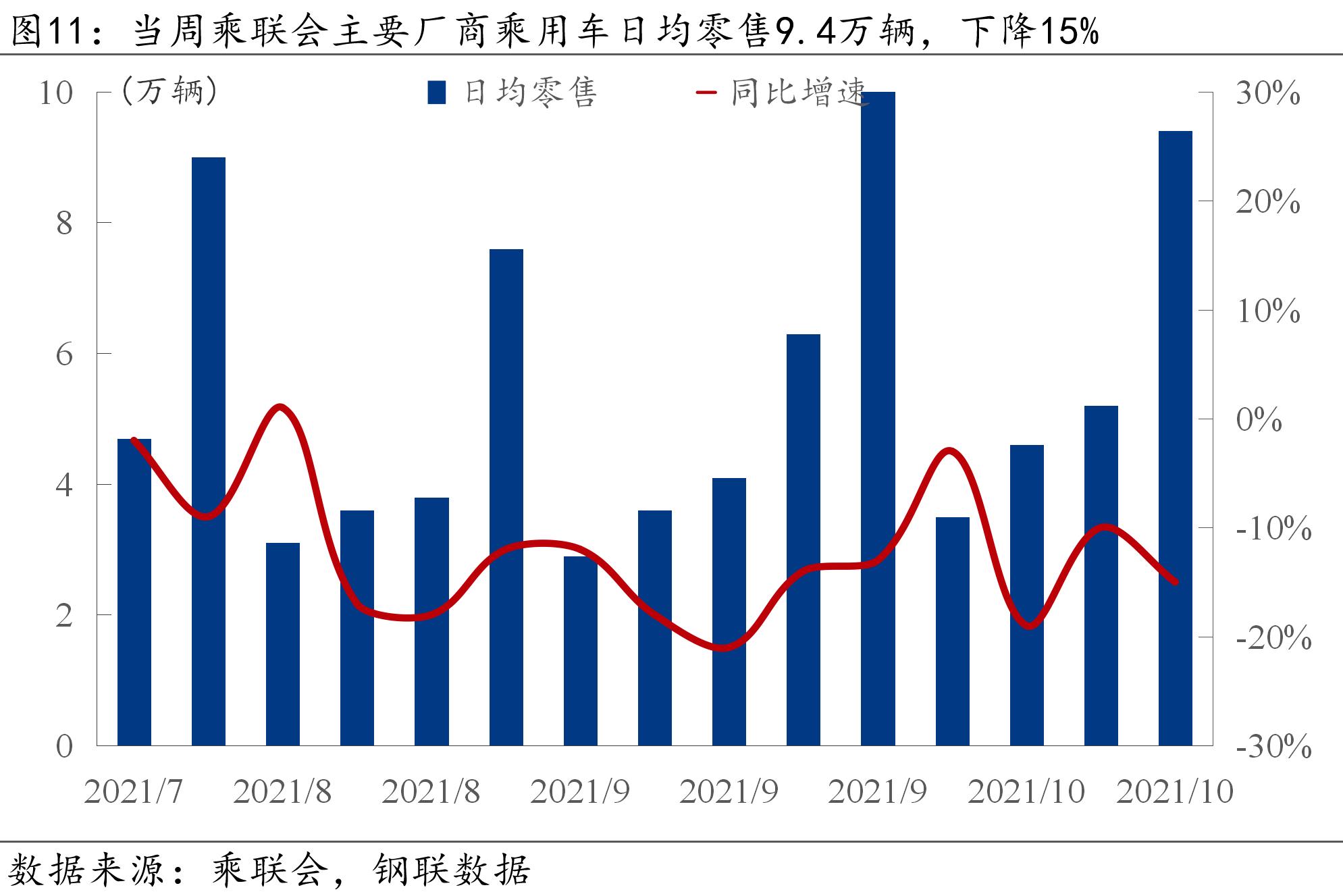

Data tracking: On the capital side, the central bank netted 780 billion yuan during the week; the operating rate of the 247 blast furnaces surveyed by Mysteel dropped to 70.9 percent; the operating rate of the 110 coal washing plants nationwide dropped by 0.02 percent; the prices of iron ore, steam coal, rebar and electrolytic copper all dropped significantly during the week; Daily sales of passenger cars averaged 94,000 during the week, down 15 per cent, while BDI dropped 23.7 per cent.

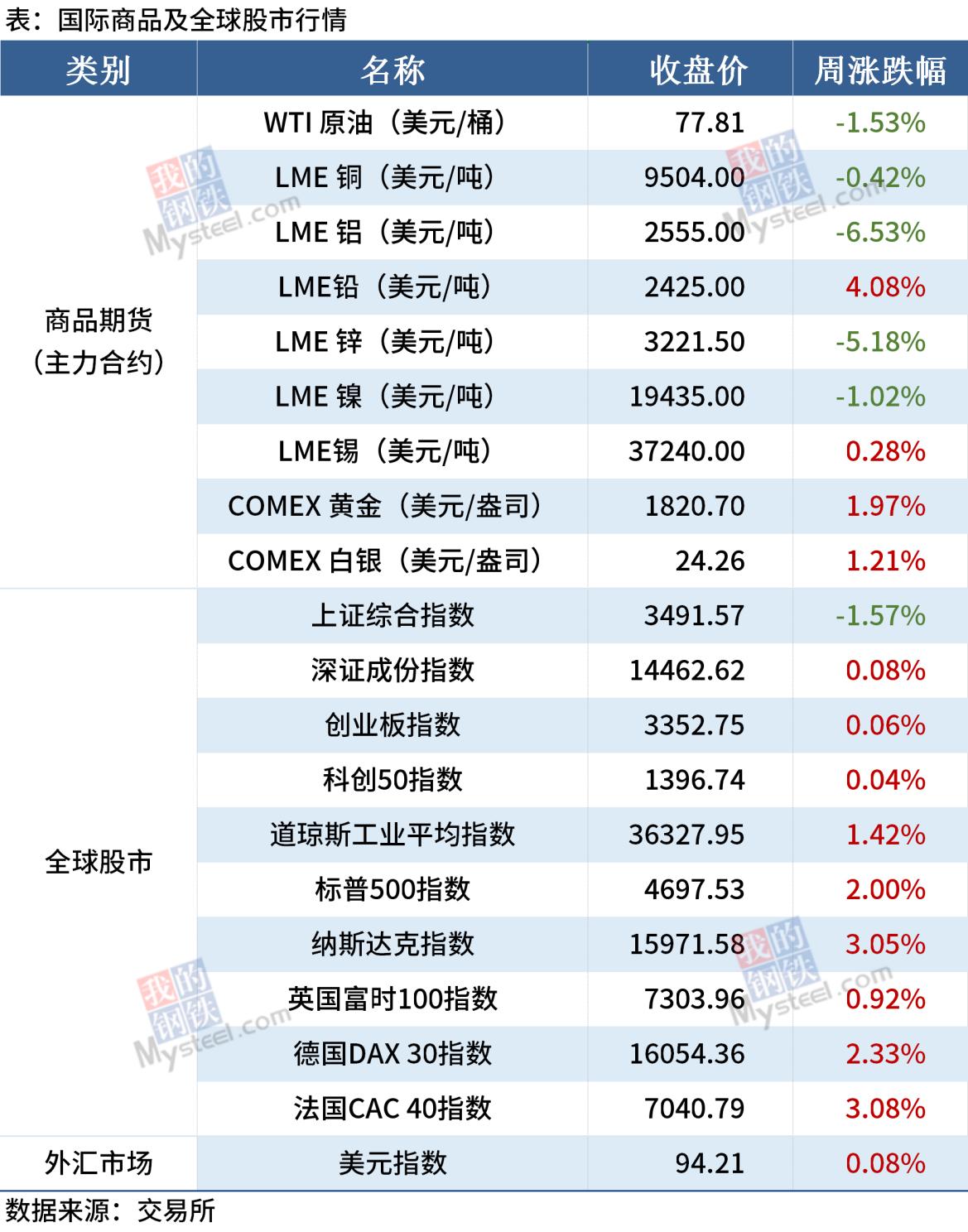

Financial Markets: Precious metals among the main commodity futures rose this week, while others fell. The three major U.S. stock indexes hit new highs. The U.S. dollar index rose 0.08% to 94.21.

1. Important Macro News

(1) focus on hot spots

On the evening of October 31, Chinese President Xi Jinping continued to attend the 16th G20 summit by video in Beijing. Xi stressed that recent fluctuations in the international energy market remind us of the need to balance environmental protection and economic development, taking into account the need to combat climate change and protect people’s livelihood. China will continue to promote the transformation and upgrading of the energy and industrial structure, promote the R & D and Application of green and low-carbon technologies, and support places, industries and enterprises that are in a position to do so to take the lead in reaching the summit, to make a positive contribution to global efforts to combat climate change and promote energy transformation.

On November 2, Premier Li Keqiang presided over the opening of the China State Council executive meeting. The meeting pointed out that to help market participants bail out, to promote the solution of high commodity prices to push up costs and other issues. In the face of new downward pressure on the economy and new difficulties of the market, effective implementation of pre-adjustment and fine-tuning. To do a good job of meat, eggs, vegetables and other necessities of life to ensure the supply of stable prices.

On November 2, Vice Premier Han Zheng visited the State Grid Company to conduct research and hold a symposium. Han Zheng stressed the need to ensure energy supply this winter and next spring as a priority. The power generation capacity of coal-fired power enterprises should be restored to normal level as soon as possible. The government should strengthen the regulation and control of coal price according to law and accelerate the research on the mechanism of market-oriented price formation of coal-electricity linkage.

The Ministry of Commerce issued the notice on ensuring a stable price for vegetables and other necessities in the market this winter and next spring, all regions support and encourage large agricultural circulation enterprises to establish close cooperation with agricultural production bases such as vegetables, grain and oil, livestock and poultry breeding, and sign long-term supply and marketing agreements.

On November 3, the National Development and Reform Commission and the National Energy Administration jointly issued a notice calling for the upgrading of coal-fired power units across the country. The notice requires that for coal-fired power generating units that consume more than 300 grams of standard coal/kwh for power supply, conditions should be created quickly to implement energy-saving retrofit, and units that can not be retrofitted should be phased out and shut down, and will have the conditions to the emergency backup power supply.

According to information on the wechat public account of the National Development and Reform Commission, following the initiative of a number of private enterprises such as Inner Mongolia Yitai Group, Mengtai Group, Huineng group and Xinglong Group to reduce the selling price of coal at Hang Hau, state-owned enterprises such as National Energy Group and China National Coal Group have also taken the initiative to lower coal prices. In addition, more than 10 major coal enterprises have taken the initiative to follow up the main production area of 5500 calories of thermal coal pit prices down to 1000 yuan per ton. The supply and demand situation in the coal market will be further improved.

On the evening of October 30, the CSRC issued the basic system of the Beijing Stock Exchange, initially setting up such basic systems as issue financing, continuous supervision and exchange governance, the entry into force date of the basic regime was specified as 15 November.

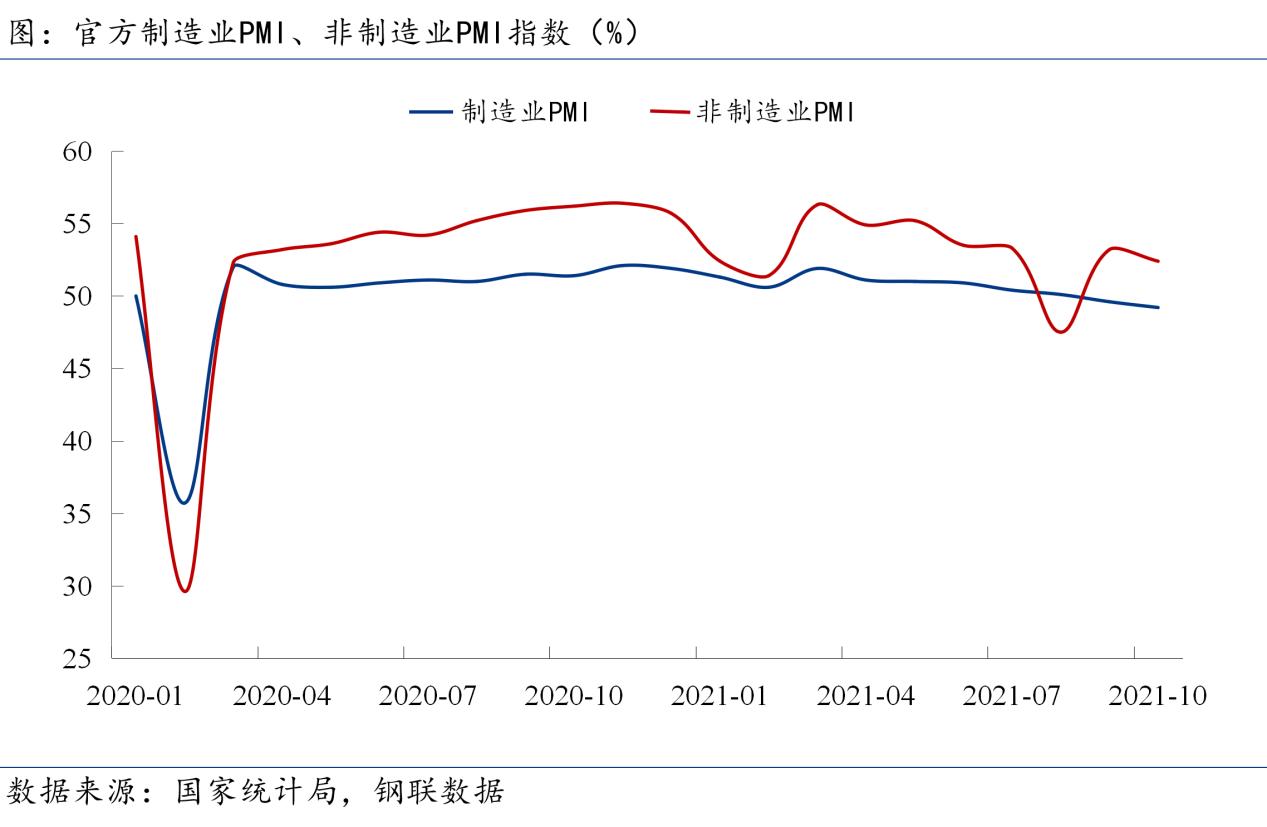

The manufacturing boom has weakened and the non-manufacturing sector has continued to expand. China’s official manufacturing PMI was 49.2 in October, down 0.4 percentage points from the previous month and continuing to be below the critical level of contraction for two consecutive months. In the case of rising prices of energy and raw materials, supply constraints appear, effective demand is insufficient, and enterprises are facing more difficulties in production and operation. The non-manufacturing business activity index was 52.4 per cent in October, down 0.8 percentage points from the previous month, but still above the critical level, indicating continued expansion in the non-manufacturing sector, but at a weaker pace. Repeated outbreaks in multiple locations and rising costs have slowed business activity. The rising of investment demand and festival demand are the leading factors for the smooth operation of non-manufacturing industries.

On November 1, Ministry of Commerce of the People’s Republic of China Minister Wang Wentao sent a letter to New Zealand Trade and Export Growth Minister Michael O’Connor to formally apply for accession to the Digital Economy Partnership Agreement (DEPA) on behalf of China.

The Regional Comprehensive Economic Partnership Agreement (RCEP) will enter into force for 10 countries including China on January 1,2022, according to the Ministry of Commerce.

The Federal Reserve released its Monetary Policy Committee decision in November to formally start the Taper process while keeping the policy interest rate unchanged. In December, the Fed will accelerate the pace of the Taper and reduce the monthly bond purchases by $15 billion.

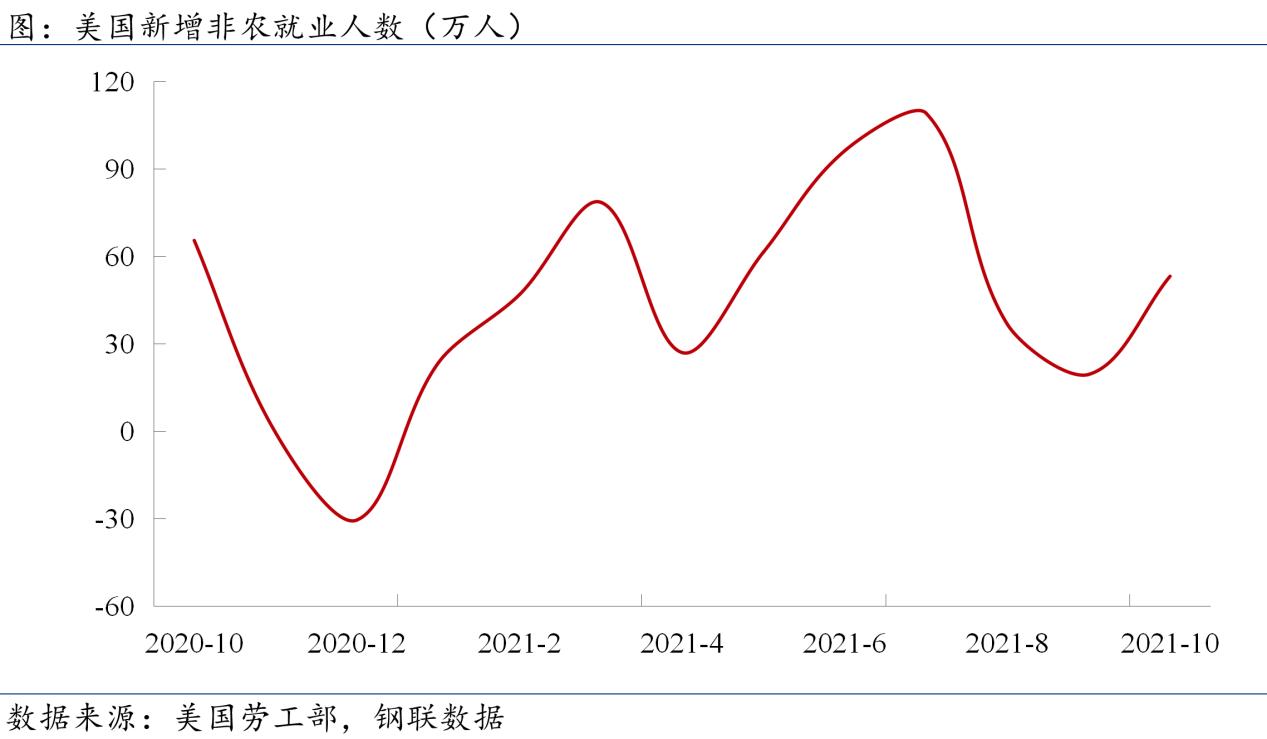

Nonfarm payrolls rose 531,000 in October, the biggest increase since July, after rising 194,000. Federal Reserve Chairman Powell said the U.S. job market could improve enough by the middle of next year.

(2) News Flash

In October, the CAIXIN China manufacturing PMI recorded 50.6, up 0.6 percentage points from September, returning to the expansion range. Since May 2020, the index has fallen into a contraction range only in 2021.

China’s Logistics Business Index for October was 53.5 percent, down 0.5 percentage points from the previous month. The issuance of new special bonds has been significantly accelerated. In October, local governments across the country issued 868.9 billion yuan of bonds, of which 537.2 billion yuan was issued as special bonds. According to the request of the Ministry of Finance, “New special debt will be issued as far as possible before the end of November”, the new special debt issuance is expected to reach 906.1 billion yuan in November. 37 listed steel enterprises released the third quarter results, the first three quarters of net profit of 108.986 billion yuan, 36 profits, 1 profit turned loss. Of the total, Baosteel was the first with a net profit of 21.590 billion yuan, while Valin and Angang were the second and third with 7.764 billion yuan and 7.489 billion yuan respectively. On November 1, the Ministry of Housing and urban-rural development said that over 700,000 units of affordable rental housing have been built in 40 cities nationwide, accounting for nearly 80 percent of the annual plan. CAA: the 2021’s inventory warning index for auto dealers was 52.5% in October, down 1.6 percentage points from a year earlier and up 1.6 percentage points from a month earlier.

In October, China’s heavy truck market is expected to sell about 53,000 vehicles, down 10% month-on-month, down 61.5% year-on-year, the second-lowest monthly sales so far this year. As of November 1, a total of 24 listed construction machinery companies reported 2021 third quarter results, 22 of which were profitable. In the third quarter, 24 companies earned a combined operating income of $124.7 billion and net income of $8 billion. The 22 listed companies of key household appliances have released their third-quarter results. Of these, 21 were profitable, with a combined net profit of 62.428 billion yuan and total operating income of 858.934 billion yuan. On November 1, the Yiju Real Estate Research Institute released a report showing that in October, the 13 hot cities monitored by the institute traded about 36,000 second-hand residential units, down 14,000 units from the previous month, down 26.9% month-on-month and down 42.8% year-on-year; From January to October, 13 cities second-hand residential transaction volume growth year-on-year for the first time negative, down 2.1% . Orders for new ships reached their highest level in 14 years in Knock Nevis. In the first three quarters, 37 yards worldwide received orders from Knock Nevis, 26 of which were Chinese yards. A new agreement was reached at the COP26 climate summit, with 190 countries and organizations pledging to phase out coal-fired power generation. OECD: Global Foreign Direct Investment (FDI) flows rebounded to $870bn in the first half of this year, more than double the size of the second half of 2020 and 43 per cent above pre-2019 levels. China was the world’s largest recipient of foreign direct investment in the first half of this year, with flows reaching $177bn. ADP employment rose 571,000 to an estimated 400,000 in October, the most since June. The US recorded a record trade deficit of US $80.9 billion in September, compared with a deficit of US $73.3 billion. The Bank of England left its benchmark interest rate unchanged at 0.1 per cent and its total asset purchases unchanged at # 895bn. The ASEAN manufacturing PMI rose to 53.6 in October from 50 in September. It was the first time the index had risen above 50 since May and the highest level since it began compiling in July 2012.

2. Data tracking

(1) financial resources

(2) industry data

Overview of financial markets

During the week, commodity futures, in addition to precious metals rose, the main commodity futures fell. Aluminium fell the most, by 6.53 per cent. World stock markets, with the exception of China’s Shanghai Composite Index fell slightly, all other gains, the United States three major stock indexes are at record highs. In the foreign exchange market, the dollar index closed up 0.08 per cent at 94.21.

Key statistics for next week

1. China will release financial data for October

Time: Next Week (11/8-11/15) comments: In the context of housing financing basic return to normal, the comprehensive institutions’judgment, new loans in October is expected to exceed the 689.8 billion yuan in the same period last year, the growth rate of social financing is also expected to stabilize.

2. China will release CPI and PPI data for October

On Thursday (11/10) comments: affected by rainfall and cooling weather, as well as repeated outbreaks in many places and other factors, vegetables and vegetables, fruits, eggs and other prices have risen sharply, CPI is expected to expand in October. To crude oil, coal as the main representative of the commodity prices were higher than the same month, is expected to further promote PPI price increases.

(3) summary of key statistics for next week

Post time: Nov-09-2021